A short study about crowdfunding by dr. Balázs FERENCZY, the Head of our Banking & Finance Team

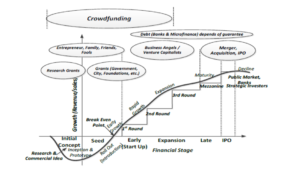

In the early stages of the lifecycle of modern, mostly technology companies, there is no final product, no organization, no go-to-market strategy, no sales; there is only one idea, and from the scarce resources temporarily provided by families or friends, to business angels (angel investors) or venture capital and, in the more mature stage, bank and institutional financing has somehow to be achieved and reached.[1] In essence, this coercion gave birth to community funding, better known as crowdfunding.[2]

With crowdfunding, fund-seeking bidders have the opportunity in case of exiting from the stage of 3F to gather funds from a large number of previously unidentified potential investors for the financing of the start-up phase of their business. The operator of the platform is separated from the group of those seeking and offering resources, and provides its services as an independent revenue-generating activity.

Among the main business models for crowdfunding developed until now the reward-based crowdfunding (Kickstarter and Indiegogo, USA), donation-based crowdfunding (Crowdrise, GlobalGiving, USA), interpersonal lending (Lending Club, Prosper), equity-based funding (CrowdCube, or Seedrs, UK) or profit-sharing/revenue sharing solutions shall be mentioned. [3]

In order to determine the legal framework for crowdfunding, some countries began to create their own regulations at national level, while others, on the grounds that it falls within the scope of the already existing regime determining the conditions on providing financial activities, have not regulated the activity at all or they regulated it to a minimal extent, only.

The EU’s draft regulation on crowdfunding fits into this line (the “Draft“)[4], which has been preceded by lengthy preparatory work and multiple consultations with market participants. The Draft has been prepared in the form of a regulation, so that once it enters into force it will be applicable in all Member States without any further legislation.

- Background

- The initiative is part of the so-called Capital Market Union (CMU), which aims to broaden access to finance for innovative companies, start-ups and other unlisted firms, which is – due to structural and information asymmetries prior to the expansion of targeted business – still in difficulty. Financing through predominantly short-term bank loans is expensive, coupled with the fact that the SME and start-up sectors, which were particularly affected by the 2008 crisis, are still struggling to return to pre-crisis financing levels: this leads to a lack of capital, which is a key factor in start-ups’ failure. According to the explanatory memorandum of the Draft, these conditions are even more pronounced in the Member States with less developed banking systems and capital markets. EU regulators see crowdfunding as one of the possible solution for the above highlighted situation, also supported by the technology sector. The structure, in the form already outlined above, aims to provide an opportunity for companies seeking capital/funding and their potential investors to find each other effectively, as projects can be identified through a given platform and can be better assessed by financiers according to their own investment criteria.

- According to the regulator, crowdfunding has clearly defined itself as one of the most important financial escalators for start-ups in the recent past, as it has proven its ability to fill up the gap between the birth of ideas and the first round investment period provided by business angels („angel investors”)/venture capitals, which is the most important but also the most vulnerable stage of these companies. According to the authors of the Draft, crowdfunding could therefore become an important alternative to financing through unsecured bank lending, which has so far been the only source for financing/funding, resulting in economic growth and new jobs.

- When the legislators began to create the concept, the EU had no idea about regulation. Numerous stakeholder consultations and expert studies since then have shown that Member States’ regulations on crowdfunding differ significantly due to different business constructions and approaches related thereto: while some Member States apply their current (EU and national-wide) legislation on financial services, others allow crowdfunding providers to be exempted under specific provisions for their business model. At the same time, a large number of Member States have established rules specifically for crowdfunding that service providers must apply when carrying out given activity. However, making crowdfunding, as a technology-based matchmaking platform that allows bidders and investors to match each other, depending on geographical location is not at all in line with the industry’s typically cross-border standards. In addition, the linking of the activity to the legal system of the given country(ies) resulted in market concentrations, which also hindered the possibilities of economies of scale.

- The Draft seeks to enable cross-border operation of crowdfunding structures for investment/profit-sharing and financing purposes in the single EU market. Its explicit objectives include the proportionate management of risk factors and the promotion of the growth of the internal market for community financial services, thus improving access to alternative sources for start-ups, and the SME sector in general. Reward or grant-based crowdfunding is not included in the scope of the Draft: according to the regulator, these business models are not based on financial products and do not address the information asymmetries arising from such products, therefore they would have an undesirable, disproportionate effect. In addition, EU consumer protection rules (eg.: the Consumer Credit Directive and the Mortgage Credit Directive) must be applied to reward-based crowdfunding activities anyway, with strict provisions on consumer safety.

- Some important provisions

- The regulation aims to create uniform set of rules for crowdfunding at EU level. It does not replace or repeal the rules already adopted by a Member State for this activity. According to the solution proposed by the Draft, the crowdfunding service provider may choose to (i) apply for an authorization from ESMA (see below) under the rules of the Draft, or (ii) to provide its service under the applicable national regulations, (or continue it including cases where related Member State orders the application of MIFID II rules to this activity).

- In the case of an authorization at EU level, the authorization also covers the provision of services on the basis of the single passporting rule in a given Member State or as a cross-border service in all EU Member States. If the service provider decides to apply EU-level rules, the authorization issued under the relevant Member State regulation will be revoked.

- In addition to the subject of the regulation, Article 1 of the Draft sets out uniform provisions for the operation, organization, licensing/authorisation and continuous supervision of crowdfunding service providers. Article 2 sets forth that the Regulation shall apply to service providers only who chose to seek authorisation in accordance with Article 10 and 11. Activities are also defined here to that the Regulation shall not apply, such as (i) crowdfunding services that are provided to consumers, as defined in Article 3(a) of Directive 2008/48/EC, (ii) crowdfunding services provided by investment firms as legal persons in accordance with Article 7 of Directive 2014/65/EU and (iii) crowdfunding services that are provided by natural or legal persons in accordance with the already approved national law. It also follows from this rule, that all persons who hold authorization issued under the Regulation will lose their license if they no longer wish to pursue their activities within the scope of the Regulation. Persons carrying out investment-based cross-border crowdfunding activities will have to apply for authorization under Directive 2014/65/EU, while their authorization to provide services under the Regulation will have to be revoked.

- Article 3 of the Regulation provides for the definitions used in the scope of the Regulation, such as “crowdfunding services“, “crowdfunding platform“, “ crowdfunding service provider“, “ crowdfunding offer“, (etc.). Important: the Regulation will empower the Commission, in its regulatory capacity, to adopt delegated acts to add further technical elements to the definitions set out in Article 3 taking into account market as well as technological developments, and experience.

- Chapter II sets forth the provision of crowdfunding services (Article 4), effective and prudent management (Article 5) and complaints handling (Article 6). Under these rules, crowdfunding service providers must in all circumstances comply with the organizational requirements imposed on them, while natural persons having the power to manage a crowdfunding service provider must have the appropriate professional experience and skill to carry out their activity.

- In order to eliminate conflicts of interest (Article 7), crowdfunding service providers, by maintaining and operating effective organizational and administrative arrangements, shall take all reasonable steps to avoid that potential conflicts of interest adversely affect the interests of their clients. The service providers are also required to take all necessary steps to identify and prevent conflicts of interest within the organization, including potential conflicts between managers and employees and the persons linked to them by way of exercising control, as well as between customers, in the course of providing services. The rules on outsourcing and safekeeping of clients’ assets are set out in Articles 8 and 9.

- Chapter III. sets forth the rules for authorization and ongoing supervision. The European Securities and Markets Authority (ESMA) is the supervisory body for crowdfunding service providers in the EU. In particular, Article 10 sets out the obligation related to the authorization of crowdfunding service providers and the conditions for obtaining authorization issued by ESMA. The Article also sets forth the procedure for obtaining the authorization and the cases in which an application may be rejected. Pursuant to Article 11, ESMA shall establish a register of all crowdfunding service providers which shall be updated on a regular basis. Article 12 provides for ongoing supervision of the conduct of the activity by ESMA, while Article 13 sets out the conditions for the withdrawal of an authorisation. ESMA’s additional supervisory powers and competencies are set out in Chapter VI. in detail.

- Chapter IV. contains provisions on investor protection as well as transparency. For the purposes of Article 14, all information, including marketing communications, from crowdfunding service providers to potential investors and offerors, shall be clear, complete and correct. Article 15 contains, as an important rule, provisions for the prior assessment of the ability of potential customers to bear loss. According to them, the platform is obliged to provide investors with the possibility to simulate their ability to bear loss. Article 16 contains detailed rules in this regard and makes the use of the so-called Key Investment Information Sheet (KIIS) mandatory. Articles 17 and 18 set forth rules on the so called bulletin board and the right of investors to access internal records.

- Crowdfunding, like any other financial service, can provide space for money laundering and terrorist financing activities. The Regulation therefore provides for appropriate safeguards to prevent and minimize the possibility of such activities. These include, inter alia, the requirement in Article 9 that transfers related to crowdfunding transactions, whether carried out by the platform providers themselves or by third parties, shall be made exclusively through payment service providers authorized under the Payment Service Directive (PSD), as a result of which these transactions fall under the scope of the 4th Anti-Money Laundering Directive (4th AMLD). Crowdfunding service providers are also required to ensure that project owners can accept funding offers or any other payments only through payment service providers authorized under the PSD. Article 10 lays down additional rules on the criminal record of the management in relation to good reputation and anti-money laundering legislation. Article 38 provides that, in order to further reduce the risks related to money laundering and terrorist financing, the Commission shall assess the need for and the extent of involving crowdfunding service providers under the scope of legislations implementing Directive 2015/849 (EU) into the national legislation of each Member State and providing rules on anti-money laundering and terrorist financing, including the definition of such service providers as obliged entities under the Directive.

- Domestic panorama

- The National Bank of Hungary (NBH) issued a number of resolutions on crowdfunding in 2015 and 2016, taking into account EBA’s opinion on lending-type crowdfunding published in February 2015. In the NBH’s view, the various versions of crowdfunding are very similar to the currently regulated financial activities. In the case of crowdfunding, the funding of private and legal persons, the transfer of money and the investment of money may correspond to the activities regulated by the Credit Institutions Act, the Act on investment firms and commodity exchange service providers and on activities they may execute, as well as the Act on collective investment schemes, which can only be pursued with the permission of the central bank or on the basis of a notification. In addition, on 25 October 2019, the MNB’s own fintech strategy was published (https://www.mnb.hu/letoltes/mnb-fintech-strategia-final.pdf), in which the supervision, in view of the fact that the worldwide growing alternative financing solutions are not regulated in Hungary, – proposes the creation of a specific regulatory framework for crowdfunding.

- Hungary’s Fintech Strategy (https://digitalisjoletprogram.hu/hu/tartalom/magyarorszag-fintech-strategiaja) also treats the development of domestic regulations on crowdfunding as a priority goal. We agree with the statement published in the article „Crowdfunding, or how could Hungarian start-ups get funds in an innovative way?” of Péter Fáykiss – Dr. Ágnes Hajzer – Benjámin Nagy (the authors are employees of the National Bank of Hungary) according to which the creation of a legal framework for crowdfunding at national level would make a significant contribution to supporting the funding of the SME sector and facilitating access to finance for FinTech companies, and to strengthening investor confidence in alternative forms of financing.

- The Regulation is expected to enter into force in Q4 2021, Q1 2022, and it would be worth for Hungary to consider joining the leading group until then. The statistics from France might serve as good example for the growth of this market: while in 2011 these type of sources amounted up to 7,9M EUR only, in 2015 this figure was already 169M EUR, and in 2019 it reached 1,4Bln EUR. Based on these figures it is obvious, that a licensed crowdfunding site, which functions well since years, intending to step under the scope of the Regulation in order to operate on the EU level for economies of scale purposes holds mile advantage compared to those who are in their wings trial and error phase. A local Hungarian crowdfunding legislation could therefore become an important station in the journey to join the EU crowdfunding market.

_______________

[1]Source: Péter Fáykiss – Dr. Ágnes Hajzer – Benjámin Nagy (the authors are experts of the National Bank of Hungary): Crowdfunding, or how could Hungarian start-ups get funds in an innovative way?

[2] Figure: The New Ways to Raise Capital: An Exploratory Study of Crowdfunding by Matteo Rossi (DEMM Department, University of Sannio, Benevento, Italy)(International Journal of Financial Research Vol. 5. No. 2; 2014)

[3]Source: Dr. Andrea Szikora (Regulatory expert of the National Bank of Hungary): Development of financial technology and Crowdfunding (National Bank of Hungary)

[4] https://eur-lex.europa.eu/legal-content/HU/TXT/HTML/?uri=CELEX:52018PC0113&from=HU